Monday, February 26, 2007

Top 10 Tax Deductions For Real Estate Investors

Today I’m going to reveal the top 10 tax deductions for real estate investors!

Now that the markets have changed many of the flippers and wholesale guys are finding tough times in the market. Before one could put any property under contract then sell it quickly for huge profits. Now the real investors are back and buying with better spreads. Sure, there are plenty of new investors out there buying foolishly, but not in the masses like before.

True investing invloves holding real estate and building wealth. If all you ever do is flip properties then you are only as good as your next deal. Think about it!

Top 10 Tax Deductions For Real Estate Investors

1. Interest

Interest is often the largest deductible for property owners. Examples include.

Mortgage interest payments on your loans for acquiring or improving rental property

Interest on credit cards for goods and services purchased for rental activity

2. Depreciation

Depending on whether you have residential or commercial property, the value of your rental property can be depreciated over a number of years and deducted from the total taxable income. Residential property is depreciated over 27.5 years.

3. Insurance

Insurance premium payments are also a deduction; including fire, theft, flood, landlord liability and employee's health/worker's compensation policies.

4. Employees/Independent Contractors

Wages for any work done on the property by your employees (property manager) or independent contractors (plumber) can be deducted as a business expense.

5. Repairs

Some repair expenses are deductible (if they are deemed ordinary, necessary and within reason) if they are incurred during the tax year you are filing for.

6. Home Office

You can deduct home office expenses provided they meet certain minimal requirements. This deduction applies to space used for office work as well as other workspaces you use to operate your rental business.

7. Local Travel

You are entitled to a tax deduction on the expenses you incur while traveling for work related to your rental activity. Traveling expenses that are related to rental activity may include driving to a property to show a unit to a prospective tenant or driving to a hardware store to pick up supplies for a maintenance task.

8. Long Distance Travel

Airfare, lodging, meals and other expenses can be deductions if you travel overnight.

9. Casualty & Theft Loss

Rental property that is damaged or destroyed by a sudden accident (such as flood or fire) may be counted as a tax deduction as well. All or part of the damage (casualty loss) may be deducted depending on how much of the property was damaged and your insurance policy.

10. Legal & Professional Services

Fees paid to accountants, attorneys, property management firms, bankers/investment advisors, or any other professional service used to operate your rental property can also be included in your deductions.

Goto www.kickasswholesaling.com to learn how to buy properties the right way. Whether you are flippingproperties, buying subject to or building a portfolio you make money when you buy. This is your ultimate real estate buying system. Now go buy a house!

Gerald Romine

www.KickAssRealEstate.com

Now that the markets have changed many of the flippers and wholesale guys are finding tough times in the market. Before one could put any property under contract then sell it quickly for huge profits. Now the real investors are back and buying with better spreads. Sure, there are plenty of new investors out there buying foolishly, but not in the masses like before.

True investing invloves holding real estate and building wealth. If all you ever do is flip properties then you are only as good as your next deal. Think about it!

Top 10 Tax Deductions For Real Estate Investors

1. Interest

Interest is often the largest deductible for property owners. Examples include.

Mortgage interest payments on your loans for acquiring or improving rental property

Interest on credit cards for goods and services purchased for rental activity

2. Depreciation

Depending on whether you have residential or commercial property, the value of your rental property can be depreciated over a number of years and deducted from the total taxable income. Residential property is depreciated over 27.5 years.

3. Insurance

Insurance premium payments are also a deduction; including fire, theft, flood, landlord liability and employee's health/worker's compensation policies.

4. Employees/Independent Contractors

Wages for any work done on the property by your employees (property manager) or independent contractors (plumber) can be deducted as a business expense.

5. Repairs

Some repair expenses are deductible (if they are deemed ordinary, necessary and within reason) if they are incurred during the tax year you are filing for.

6. Home Office

You can deduct home office expenses provided they meet certain minimal requirements. This deduction applies to space used for office work as well as other workspaces you use to operate your rental business.

7. Local Travel

You are entitled to a tax deduction on the expenses you incur while traveling for work related to your rental activity. Traveling expenses that are related to rental activity may include driving to a property to show a unit to a prospective tenant or driving to a hardware store to pick up supplies for a maintenance task.

8. Long Distance Travel

Airfare, lodging, meals and other expenses can be deductions if you travel overnight.

9. Casualty & Theft Loss

Rental property that is damaged or destroyed by a sudden accident (such as flood or fire) may be counted as a tax deduction as well. All or part of the damage (casualty loss) may be deducted depending on how much of the property was damaged and your insurance policy.

10. Legal & Professional Services

Fees paid to accountants, attorneys, property management firms, bankers/investment advisors, or any other professional service used to operate your rental property can also be included in your deductions.

Goto www.kickasswholesaling.com to learn how to buy properties the right way. Whether you are flippingproperties, buying subject to or building a portfolio you make money when you buy. This is your ultimate real estate buying system. Now go buy a house!

Gerald Romine

www.KickAssRealEstate.com

Friday, February 23, 2007

The 7 Secrets To Keep You Buying Right In Today's Changing Market

When evaluating property first determine the ARV(After Repaired Value).

Here are 7 Secrets to keep real estate investors buying right:

1) Use comps that are less than 6 months old

2) Keep the square footage within 10%.

3) Keep the year built to within 5 years

4) Be on the lookout for falling values

5) Check MLS – Properties currently listed could be offered at less than yesterday’s sold statistics

6) Location – If a SFR house fronts a busy street or is close to a large commercial property/apartment/etc deduct 10% of it’s value

7) Compare to properties in the same subdivision is possible. After that book/map or a radius of .5 mile is best.

Gerald Rominewww.KickAssRealEstate.com

PS – The secret to real estate investing success lies in the system you use to buy properties right. Check out the best buying system in existence today because once you put it in place you’ll never imagine your life without it again.

Here are 7 Secrets to keep real estate investors buying right:

1) Use comps that are less than 6 months old

2) Keep the square footage within 10%.

3) Keep the year built to within 5 years

4) Be on the lookout for falling values

5) Check MLS – Properties currently listed could be offered at less than yesterday’s sold statistics

6) Location – If a SFR house fronts a busy street or is close to a large commercial property/apartment/etc deduct 10% of it’s value

7) Compare to properties in the same subdivision is possible. After that book/map or a radius of .5 mile is best.

Gerald Rominewww.KickAssRealEstate.com

PS – The secret to real estate investing success lies in the system you use to buy properties right. Check out the best buying system in existence today because once you put it in place you’ll never imagine your life without it again.

Friday, February 9, 2007

The Computer Is A Real Estate Investors Best Friend

These days real estate investors spend a lot of time on the computer. Websites, MLS, comp research, tax offices, and the list goes on. I’m an impatient guy and my computer was dragging along so I needed to do some good old computer maintenance.

Check out http://www.techsupportalert.com/best_46_free_utilities.htm and if your computer is running slow consider #26 to clean your registry. And if you don’t know what I’m talking about you definitely need #26. There’s a lot more there plus Gizmo gives awesome descriptions.

Happy Investing.

Gerald Romine

PS – And when you need speed with your real estate analysis and paperwork Real Estate Profit Pro makes it a breeze!

Friday, February 2, 2007

Why You Should Always Invest Based On The Numbers

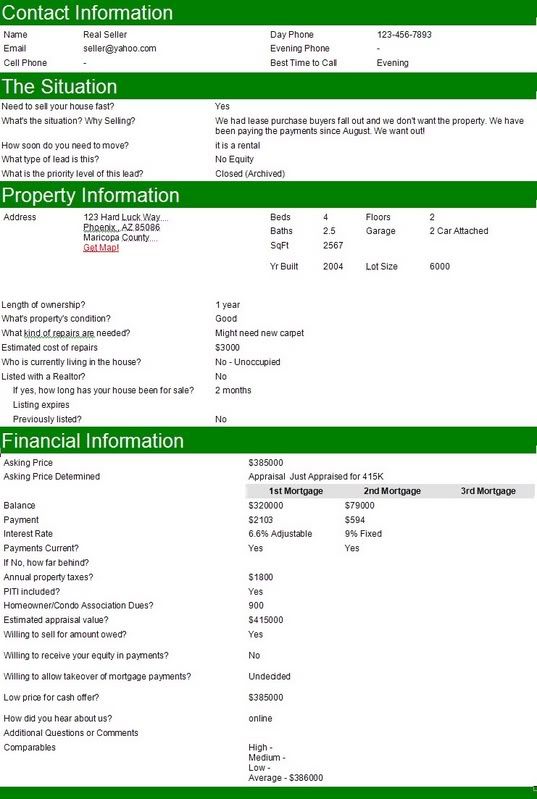

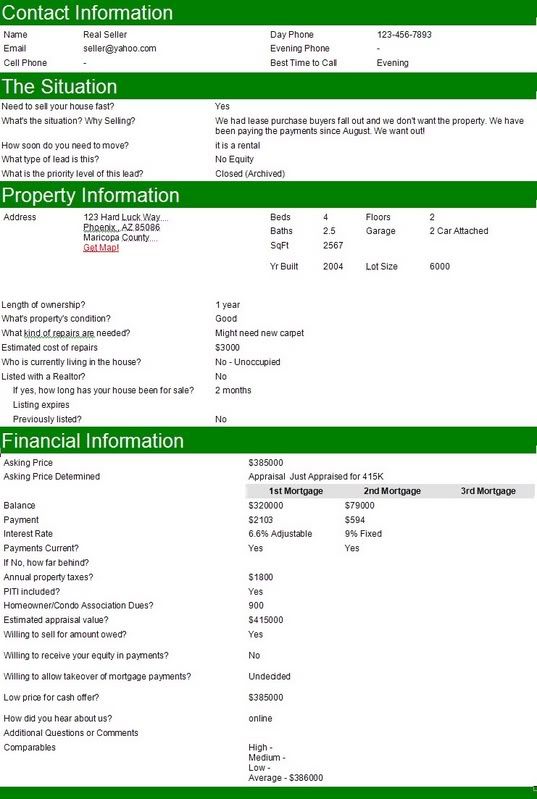

I received a call from a seller that desperately wanted to sell her investment house . This deal illustrates a great point of why you want to invest in the numbers based on a system like Kick Ass Wholesaling (which covers buying for cash and subject to).

Last January she bought the house for 400K and it included a tenant with PREPAID rent and an Option to buy the property. With great appreciation expected to continue she was not too worried about the negative cash flow even though her payments were over $2700 per month. Plus, she was getting prepaid rent at the closing when she bought the property!

Shortly after closing the tenant moved out. Because of the prepaid rent and option all she could do was wait for the lease and option to expire. In the meantime the tenant moved in and out of the house several times. Her hands were tied. In the meantime the market tanked.

Fast forward to today and the house just appraised for 415K... unfortunatelythe appraisal is worthless because the average sale price is 386K in the subdivision. Market value for leasing the property is under 1500 per month. She has great credit that she wants to protect. Her options are few.

Below is the actual lead sheet I received for your review(double click lead sheet to view a readable copy).

Today’s lesson is… invest based on today's numbers and not the future values and appreciation.

This seller has very few options but if she had followed fundamental investing like those in http://www.kickasswholesaling.com/ she would have never purchased this property. As it sits she can expect at least a 50K loss, trashed credit, or carrying the negative cash flow until appreciation covers her poor investing decision.

Hopefully you can learn from her mistakes.

Now go buy a house!

Gerald Romine

Last January she bought the house for 400K and it included a tenant with PREPAID rent and an Option to buy the property. With great appreciation expected to continue she was not too worried about the negative cash flow even though her payments were over $2700 per month. Plus, she was getting prepaid rent at the closing when she bought the property!

Shortly after closing the tenant moved out. Because of the prepaid rent and option all she could do was wait for the lease and option to expire. In the meantime the tenant moved in and out of the house several times. Her hands were tied. In the meantime the market tanked.

Fast forward to today and the house just appraised for 415K... unfortunatelythe appraisal is worthless because the average sale price is 386K in the subdivision. Market value for leasing the property is under 1500 per month. She has great credit that she wants to protect. Her options are few.

Below is the actual lead sheet I received for your review(double click lead sheet to view a readable copy).

Today’s lesson is… invest based on today's numbers and not the future values and appreciation.

This seller has very few options but if she had followed fundamental investing like those in http://www.kickasswholesaling.com/ she would have never purchased this property. As it sits she can expect at least a 50K loss, trashed credit, or carrying the negative cash flow until appreciation covers her poor investing decision.

Hopefully you can learn from her mistakes.

Now go buy a house!

Gerald Romine

Subscribe to:

Posts (Atom)