Last January she bought the house for 400K and it included a tenant with PREPAID rent and an Option to buy the property. With great appreciation expected to continue she was not too worried about the negative cash flow even though her payments were over $2700 per month. Plus, she was getting prepaid rent at the closing when she bought the property!

Shortly after closing the tenant moved out. Because of the prepaid rent and option all she could do was wait for the lease and option to expire. In the meantime the tenant moved in and out of the house several times. Her hands were tied. In the meantime the market tanked.

Fast forward to today and the house just appraised for 415K... unfortunatelythe appraisal is worthless because the average sale price is 386K in the subdivision. Market value for leasing the property is under 1500 per month. She has great credit that she wants to protect. Her options are few.

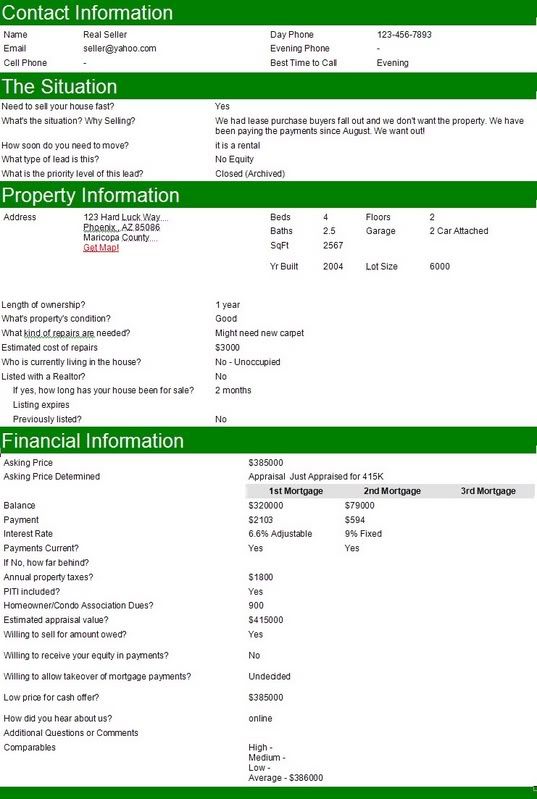

Below is the actual lead sheet I received for your review(double click lead sheet to view a readable copy).

Today’s lesson is… invest based on today's numbers and not the future values and appreciation.

This seller has very few options but if she had followed fundamental investing like those in http://www.kickasswholesaling.com/ she would have never purchased this property. As it sits she can expect at least a 50K loss, trashed credit, or carrying the negative cash flow until appreciation covers her poor investing decision.

Hopefully you can learn from her mistakes.

Now go buy a house!

Gerald Romine

No comments:

Post a Comment